Introduction

If an investor is investing in a "turnkey" property, they need only show up, put the new key in the new lock, and turn it to get access to their newly renovated property. It would be great if it were always the case. All critical systems SHOULD have been inspected, appropriately repaired, replaced, or at the very least inspected and determined to be in good operating order with at least a few years of life left before they need to be replaced. These include plumbing, electrical work, heating, ventilation, air conditioning, and roofing.

Moreover, if the flooring, finishes, worktops, door hardware, and faucets aren't up to par, they should have been replaced. Potential buyers often hear about real estate investors who have flipped tens or hundreds of thousands of homes with no failures. Can we be sure that this is still the case? Yes, but only up to a point. All around the United States, prospective buyers can still find fully functional homes. Much more than you could ever hope to learn about or afford.

How a Turnkey Property Works

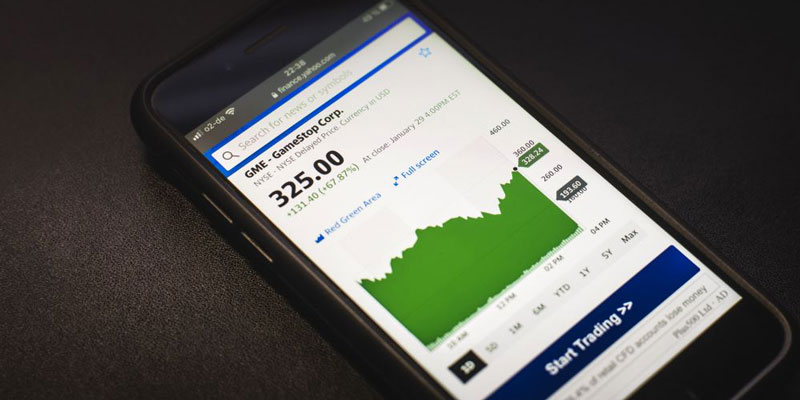

After the housing market crashed in 2007 and 2008, making it cheaper to buy than to rent in much of the United States, the demand for turnkey properties skyrocketed. Indeed, buying is 30% cheaper than renting nationally and considerably less expensive in several low-cost-of-living locales. Investors in cities like New York, where the cost of property is high, can diversify their portfolios by purchasing rental properties in less expensive parts of the country and then employing property managers to handle tenant relations. At the same time, the investors do nothing but reap the financial benefits.

What To Look For In A Turnkey Property

It is essential to know what to look for in turnkey investment properties, including possible red flags, because of the high level of trust in a turnkey property company, often from a distance. Finding a turnkey property in a dynamic market with a large tenant pool and promising rental returns is ideal for investors. As reported by Think Realty, Macon, Ohio, Toledo, Michigan, and Pittsburgh, Pennsylvania, are among the top rental markets this year. Average rental returns from single-family homes, local industry and employment growth, local housing affordability, and historical performance all played a role in selecting these markets. A solid rental population in a market can convince investors that the market is an excellent place to spend their money.

Where Can I Find Turnkey Rental Properties?

Here are some sites to begin your search for turnkey properties if you're interested in long-distance real estate investing.

Roofstock

Roofstock's popularity has skyrocketed, and for a good reason. In this way, Roofstock facilitates remote real estate investment in a way that is both accessible and manageable. Before listing a property, they get it inspected by an independent third party and provide a wealth of information about it to potential buyers and investors.

Corporate Turnkey Property Sellers

Larger businesses are increasingly interested in turnkey property investing and catering to out-of-town real estate investors. For instance, Norada Real Estate has properties in multiple states, including the South and Midwest. Some companies that specialise in renting out properties also provide buyer financing. Norada, in many transactions, will offer seller finance.

Pros Of Turnkey Properties

The property is in move-in-ready condition. Attracting a tenant should be a relatively smooth procedure. The property should require little in the way of maintenance or upgrades. Some turnkey properties may have reduced repair expenditures in the first few years since they have recently been refurbished. This might mean much money coming in for the first several years.

Cons Of Turnkey Properties

In real estate investing, turnkey properties are not always the most cost-effective option. The frequent need for maintenance and repair is usually to blame for this. A more significant down payment combined with the higher price of a turnkey house leaves little room for extra equity. Some investors who would instead make the repairs themselves will tell you there are "no deals" in this market.

Should You Invest in a Turnkey Property?

Even though turnkey properties simplify the process, numerous variables must be considered before making a final decision. One of the biggest dangers you face as an investor is having to evict renters who don't pay their rent, so be careful to set it up ahead of time. Don't only rely on photographs and descriptions offered by sellers and brokers; go check out some bargains in person.

Conclusion

A common feature of turnkey properties is that they have recently undergone maintenance and repair. The purchase of prefabricated homes that are ready to be moved into is a common investment strategy today. New owners rent out most property after purchase.