For the self-employed, navigating the path to a secure retirement requires careful planning. Selecting the right retirement plan is a crucial decision, offering not only financial security in your golden years but also personalized tax advantages tailored to your unique business. Understanding the nuances of Solo 401(k)s and SEP IRAs is essential, as these options empower you to take control of your retirement savings and effectively manage tax liabilities.

This comprehensive guide has served as a roadmap, outlining the key features of both plans and their potential benefits. By considering your specific circumstances, including contribution limits, eligibility requirements, and administrative needs, you can determine which plan best integrates with your financial blueprint and operational structure.

Remember, this guide is just the first step. To ensure you select the plan that optimizes your long-term financial security, consulting with a qualified financial advisor is highly recommended. Their personalized guidance can help you navigate the intricacies of each plan and tailor a strategy that aligns perfectly with your unique financial goals and business setup. With careful planning and the right tools at your disposal, you can confidently chart your course towards a comfortable and secure retirement.

Understanding Solo 401(k) and SEP Plans

Getting a grip of the definitions and the requirements of the various pension programs is critical for determining the best retirement plan for you.

The Solo 401(k) is a specialized plan formulated for owner-only businesses, which may include an owner's spouse, working in the business. The plan is designed so that both the employer and employee can contribute, thus making sure that the retirement savings are at the maximum level.

Key Features of the Plans

Such plans generally offer high limits on contributions and tax benefits, loan options, and a Roth account feature that is particularly appealing for individuals who want to have the opportunity to make the maximum contribution and also to enjoy greater financial flexibility.

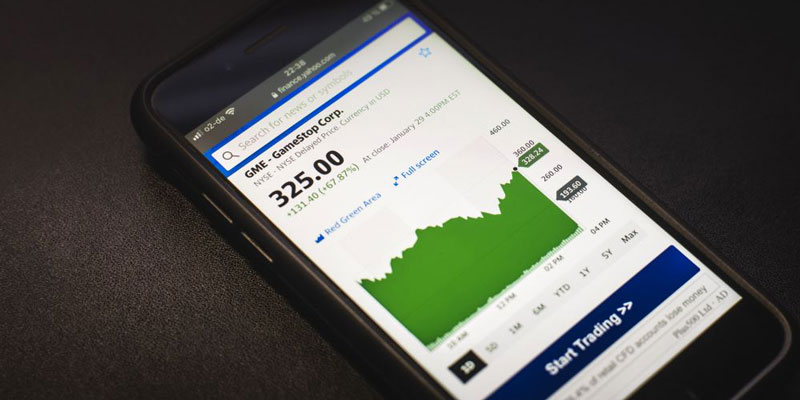

For 2023, the annual contribution limit was $66,000, or $73,500 in case of those aged 50 and older. It includes deferrals of up to $22,500 of employee compensation plus 25% of the pay as employer's contribution. This dual structure of contribution is a distinct advantage for self-employed people who can save more money for their retirement as compared to the IRA options used by the traditional system, which can provide them with a substantial boost in their retirement savings.

Solo 401(k) plans have tax benefits including the ability to make tax-deductible contributions, which are critical for the self-employed. Tax deductibility on the part of employers likewise decreases the taxable income of the year. Contributions from employees can be deducted from a pre-tax basis which lessen the taxable income in the year of contribution or they can be made as Roth contribution, where the withdrawals in retirement are tax-free. The earnings from the programme are accumulated tax-deferred, a feature that enables the capital to grow without the impact of taxes each year, which can boost long-term investment performance greatly.

The loan in this plan is not taxed for the period it is outstanding as long as it is repaid according to the schedule within five years. This is a function which enables the policyholders to get hold of the funds whenever they need it for personal or business needs without the need to pay a withdrawal fee before the due date. This service is most important in the situations like in financial emergencies or opportunities where liquid capital is needed.

A Roth option in Solo 401(k) plans enables contributors to pay taxes before making contributions, which grow on a tax-free basis and are untaxed upon retirement. This mitigation though does not decrease taxable income in the current year, but it does give tax relief to those who think that tax rates will be higher in later years. This option is very attractive especially for individuals who are at a lower tax bracket at the moment but who expect to earn more and pay higher taxes as their careers advance or for those who want to save for retirement by having tax-free income.

Key Features of SEP Plans

SEP allowances afford very favorable contribution limits. This high ceiling grants SEPs the opportunity for business owners who are saving large amounts for their retirement while also giving their employees a good deal. These regulations are particularly useful if a person has a high salary and wants a high before-tax amount to be saved quickly.

Ease of Setup and Maintenance

The main plus of SEP plans is the ease of setup and maintenance which they are introduced with. SEPs are simpler compared to the other plans; therefore, they can be set up quickly with no much bureaucracy. A plan sponsor may get the plan up and running by submitting IRS Form 5305-SEP. As opposed to the normal IRS filing, the employer doesn't have any annual filing requirements which lessens the administrative burden and makes it perfect for businesses with no HR departments.

Scalability for Business Growth

Scalability is one of the main advantages of SEPs, which is the reason for businesses that are going through the stage of growth to choose them. With the growth of the business and the hiring of more employees, the employer contribution will be adaptable and adjustable to the increasing payroll. The scalability allows the retirement plan to be commensurate with the growth of the business, and as such, the plan changes smoothly together with the development of the business without a plan review. The retirement benefits availed to the new and existing employees remain uninterrupted.

Conclusion

Weigh the contribution limits – Solo 401(k)s offer significantly higher contribution potential for those with strong earnings. Consider eligibility – Solo 401(k)s are ideal if you have a spouse working in the business, while SEP IRAs work for sole proprietors with no employees. Don't forget about administrative ease – SEP IRAs are generally simpler to set up and manage. Ultimately, both plans provide tax-advantaged savings for a comfortable retirement. Regardless of your choice, consulting a financial advisor can ensure you pick the plan that best aligns with your long-term financial goals.